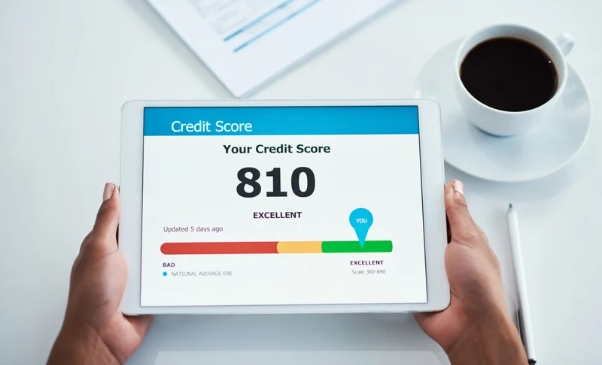

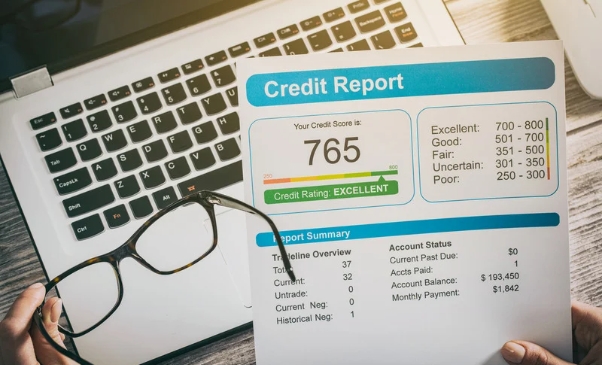

People with excellent credit are more likely to be accepted for mortgages and car loans at better interest rates and terms than people with average credit. You can also get credit cards with perks and points programs worth signing up for.Credit scores are made using a credit-scoring method, which may be unique to a single company (like FICO or VantageScore) or the industry standard. These models may use information from many places to determine your credit score. The three credit companies Equifax, Experian, and TransUnion are the most important of these sources.

Benefits of a Good credit score:A person with a Very Good credit score has shown that they have paid their bills on time and used credit wisely. Their credit score shows this. Your credit report has almost no bad things about you if any at all. This is something good. If they do, they must be pretty old and have been born at least a few years ago.People with credit scores of 746 are usually good at meeting their financial responsibilities, as only 23% of their credit records show they were late with payments.Because you have an Excellent credit score, financial companies like banks and credit card companies are interested in doing business with you. Customers with higher-than-average credit scores are more likely to be able to negotiate better loan and credit card terms with lenders. You can get credit cards with fair interest rates and attractive bonuses. You can also refinance current loans at better interest rates than the ones you could get in the past. These are two examples of the benefits you can get.How to get a 746 credit score:You can boost and maintain your credit score, but there is no surefire solution. Credit management is the best way to enhance your money. There are a lot of different credit scores because different scoring systems and credit companies store different kinds of information. However, there are still some basic rules that must be followed. Most companies look at at least five common factors when determining a person's credit score.Payment history:One of the most important things that affect your credit score is how on time you have been with payments in the past. Building credit is more accessible if you have a past of paying your bills on time. This will help you a lot when you're trying to build credit. On the other hand, if you are ever late with a payment, it could ruin your credit and stay on your record for up to seven years. Keeping things in order is more important.Credit utilization:If you carry a balance from one month to the next, the best way to save money on your spending is to pay off your credit cards in full monthly. Most people who work in finance say that you should keep your amount of open credit at about 30 percent, and some think it should be even lower.Length of credit history:The better off you'll be, the longer you've been able to keep your credit records clean and free of significant problems. Lenders can determine how knowledgeable you are about credit based on your long credit history and how many accounts you have kept.Credit mix and types:It is constructive to show potential lenders that you know how to handle open credit (like credit cards) and monthly credit (like auto loans and mortgages). So, if you want your credit score to go up, you shouldn't take out a loan you don't need.

Recent credit:When you ask for a new loan or line of credit, your credit file gets a note called a "hard inquiry." This is done on its own. If you only do one complex search, it should have little effect on your credit score. However, if you do several, it could hurt your score. But your questions will have a much bigger chance of being answered if they are apparent. It is a good idea to apply for credit when you are sure you will get it and need the money. Only ask for credit goods when you need them. If you ask too many credit-related questions in a short amount of time, some lenders may be hesitant to give you credit.Auto loans for good credit:Car loans with the lowest interest rates are often given to people with good to excellent credit. Even so, car lenders may use different standards to decide what "good" credit looks like. Lenders may look at more than standard credit scoring models like FICO and VantageScore. They may also look at credit scores specific to a business, like FICO® Auto Scores. Lenders don't just look at traditional credit score methods like FICO and VantageScore. When making these grades, the car loan business was taken into account.If you get pre-approved first, you may have a better chance of getting the lowest possible interest rate on a car loan. With preapproval letters, you can do both things quickly and easily simultaneously. By bringing a preapproval letter from your bank, you can show car sellers you have researched and won't settle for lousy loan terms. Remember that a complex search may briefly lower your credit score, so be careful what you do. This is very important to remember. You should make sure that you're ready for anything.Also, if you got your car loan a while ago and your credit has improved, you can refinance into a new loan with a better interest rate. Even if you already have an auto loan, you should still look into getting a second one.Mortgage rates for good credit:Your credit score is just one of many things that will be considered when deciding whether to give you a proper mortgage rate. Other things will also be considered, like your pay and how long you've been working. Your credit score could affect the interest rate you pay on loan, but several other things could have a more significant impact:

- Which type of home financing do you like best, and why?

- How much money does it take to build a house?

- The amount of money that a buyer pays toward the price of an item or service as a down payment.

- The standard bare requirement for a credit score is to be able to buy a home.

- It's also likely that the house's position has a lot to do with all of this.

When you have a good idea of your credit score, how much house you can afford, and what kind of loan you want, it's time to start comparing mortgages. With this knowledge, it might be easier to understand the different loan plans different financial companies offer.Personal loan with 746 credit score?

If your credit score is 746, most financial institutions will give you the personal loan you want. You almost certainly meet the standards to get the highest possible interest rates.. It would be best if you remembered this significant fact. Your income, job experience, and how much your income goes toward paying off debt will all be considered.ConclusionCredit scores above 746 are considered Excellent, although there is always room for improvement. The best financing options, including the most affordable interest rates and fees, are available to those with credit scores of 800 to 850. Individuals whose credit ratings fall between 800 and 850 are eligible for these perks. If you want the lowest possible interest rates on loans, you'll need to raise your credit score to the Exceptional range. With these guidelines in mind, you can zero in on the specifics of your financial past that have the greatest impact on your FICO score. Find out what makes for a good credit score and how that number is calculated.